Quarterly Market Review: Q1 2021

- tauruscapitalmgmt

- Apr 26, 2021

- 3 min read

Updated: Jan 6

Stock Market Optimism, Inflation Fears

The first quarter of 2021 brought a renewed sense of optimism regarding progress against COVID-19, reinforced by the incredible market rebound since this time last year. It is pretty phenomenal that on a year-over-year basis, the US stock market gained 60% since this time last year.

Global stocks were up for the quarter, while bonds (US and international) posted negative returns. Interestingly, parts of the markets that had been hot (for years, in some cases) turned cold - and vice-versa. Value stocks led the market while energy stocks topped all sectors at +31%. Growth stocks struggled with technology companies landing in the unusual position as the worst performing sector.

On the bond side, expectations for inflation have begun to emerge, even as the Federal Reserve says it won’t likely consider raising rates until 2022 at the earliest. This led to first-quarter losses across sectors of the bond market most sensitive to rising interest rates. Treasuries were hit the hardest, followed by corporate bonds. The Morningstar US Treasury Bond and Core Bond indexes both recorded their worst quarter in the 21-year history of the benchmark.

Economic Indicators at a Glance

Below is a snapshot of key top-line economic indicators.

Data source: Trading Economics. 2021.

Market Summary First Quarter 2021 Index Returns

Stocks were up across the board, while bonds around the world were down in Q1.

U.S. Stocks

First Quarter 2021 Index Returns

There were small bumps here and there along the way, but overall U.S. stocks delivered a solid 6.35% return in Q1, hitting a new high on March 15. The black line in the graph below shows the U.S. stock market performance over the first quarter.

As I mentioned, the most impressive story really is the massive US stock market climb from April 2020 to April 2021 (black line below).

This past quarter, smaller companies more closely relying on the overall U.S. economy were among the top performers. Dividend paying companies, which struggled in 2020, also recovered in the first quarter.

International Stocks & Emerging Market Stocks

First Quarter 2021 Index Returns

Volatility picked up across global markets in Q1, returning to volatility levels close to historic averages. The majority of country indexes were up for the quarter, with the exception of China which was close to flat. UK stocks had a rough Q4, losing 11%, but turned around with 4.14% gains in Q1.

Fixed Income

First Quarter 2021 Index Returns

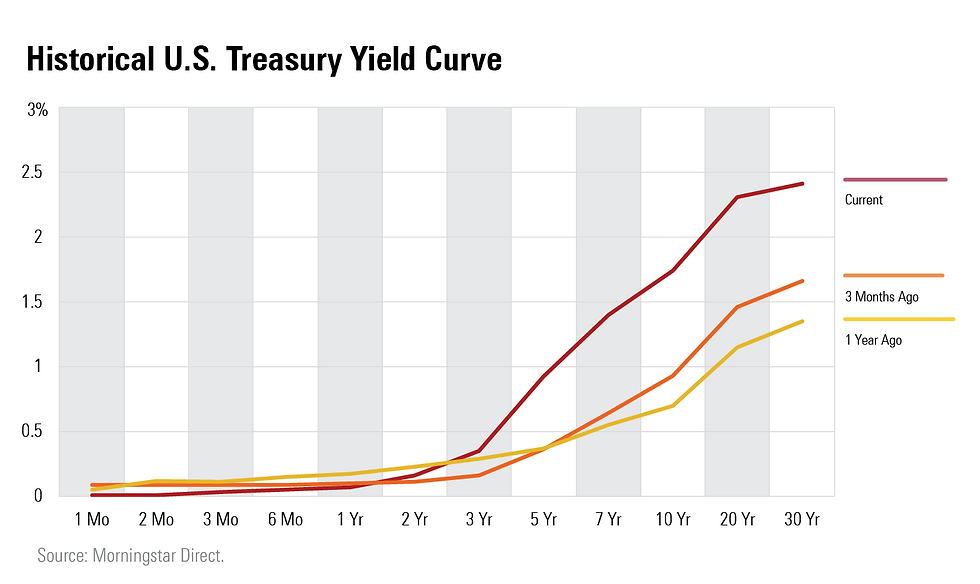

Concerns about future inflation impacted long-term bonds, causing the yield curve to steepen sharply, even compared to the start of the year.

The 10-year yield has climbed 1.04 points since last year and returned to pre-COVID-19 levels by the end of the first quarter. That said, the hard hit taken by U.S. Treasuries turned its one-year returns negative, while US corporate bonds are still up 9% from a year ago. U.K. government bonds lost 7.2% and government bonds dropped 6.2% globally.

This report was prepared by Gregory Saliba.

Gregory Saliba

President, Taurus Capital Management

(503) 756-2972

20+ years in Corporate Finance, Debt Capital Markets and Investment Management

2010 Oregon Ethics in Business Award Recipient

Public Speaker on Risk, Behavioral Finance and Ethics

Finance Faculty Member (12+ years)

Willamette University, Atkinson Graduate School of Management

Portland State University, School of Business Administration

Extensive Community Involvement

Comments