2025-2026 Contribution Limits & Year-End Reminders

- tauruscapitalmgmt

- Jan 13

- 3 min read

IRS Announcements

The IRS has released new tax brackets, standard deductions, and retirement account contribution limits for 2026, and there are some noteworthy changes taking effect this year for high earning employees age 50 and over.

Retirement Account Contribution Limits

Across all retirement account types, contribution limits are increasing in 2026. For workplace retirement plans such as a 401(k), 403(b), or Solo 401(k), the employee deferral maximum is increasing from $23,500 in 2025 to $24,500 in 2026 for employees under age 50. Employees ages 50-59 and 64 or older will be able to contribute an additional $8,000 catch-up contribution, for a total of $32,500. Employees ages 60-63 have a larger catch-up contribution maximum of $11,250, for a total salary deferral limit of $35,750.

A change starting in 2026: For individuals ages 50+ who earned more than $150,000 in 2025, all catch-up contributions (anything above $24,500) will be automatically designated as Roth (after-tax). This is a change that should be automated by your company’s 401(k)/403(b) provider, but it’s a good idea to confirm with your employer that no additional steps are needed on your part.

After remaining unchanged last year, Traditional IRA and Roth IRA contribution limits are also increasing in 2026 to $7,500 for those under age 50, and $8,600 for those 50+.Below is a chart detailing the 2026 maximum contributions by account type:

And as we close out 2025, here is a reminder of the contribution limits for this year:

Contribution Deadlines

Employees participating in employer 401(k), 403(b), or SIMPLE IRA plans: Your contributions must be deposited in the 2025 calendar year to count toward this year.

Solo 401(k): We highly recommend making your employee deferral contribution prior to December 31, and your employer deferral prior to filing your taxes.

SEP IRA, Roth IRA, and Traditional IRA: Contributions can be made up until you file your taxes.

Backdoor Roth IRA: Contributions must be made before December 31 to count for 2025.

Increased Standard Deduction

The recent OBBBA bill raised the standard deduction, starting retroactively in 2025. Here are the amounts for 2025 and 2026:

New Additional Deduction for Individuals age 65+

For 2025-2028, there is a new additional $6,000 deduction for individuals who are age 65 and older, which begins to phase out when a taxpayer’s modified adjusted gross income (MAGI) exceeds $75,000 ($150,000 if married filing jointly).Higher State & Local Taxes (SALT) CapThe OBBBA provides a temporary increase in the limit of the federal deduction for state and local taxes (the "SALT" cap) from $10,000 to $40,000, starting in 2025. The limit will increase to $40,400 in 2026. The deduction is reduced for taxpayers who are single, head of household, and married filing jointly with a modified adjusted gross income (MAGI) over $500,000 in 2025.

Updated Tax Brackets

Tax brackets and capital gains taxes are also being adjusted due to inflation. Below are the updated figures for 2025 and 2026:

Social Security

Social Security payments are adjusted annually based on inflation. The Social Security Administration has announced a cost-of-living adjustment (COLA) increase of 2.8% in 2026.

Required Minimum Distributions (RMDs)

As a reminder, anyone age 73 and up must take Required Minimum Distributions (RMDs) annually out of Traditional IRAs and pre-tax retirement plans (401(k)s, 403(b)s, SEP IRAs, and SIMPLE IRAs). In addition, anyone with a Beneficiary IRA, regardless of age, is also required to take RMDs.

All RMDs must be processed before the end of the year. Anyone who has taken an RMD will receive a Form 1099-R at tax time next year to include in their tax filing. We will send out reminders when these forms are available. Please reach out if you have any questions.

Charitable Giving

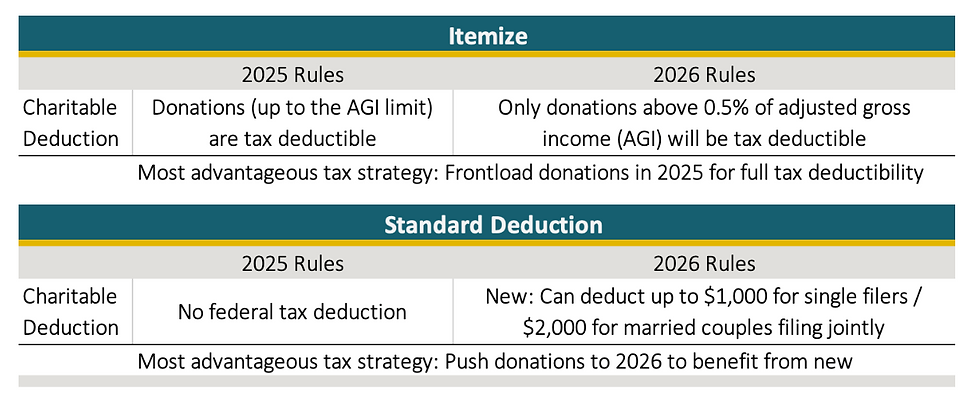

In 2026 charitable giving deduction rules will be changing, and the impact depends on whether you take the standard deduction or itemize:

Year-End Reminders

Not maxing out your retirement account contributions? If you're participating in an employer-sponsored retirement plan like a 401(k), 403(b) or SIMPLE IRA, it's a good time to think about increasing your contribution – even a 1% increase makes a difference.

Sitting on cash? If you have more than 6 months of living expenses in the bank please reach out, as we can provide recommendations to put the cash to work for you.

__

Please note that this information is intended to serve as a reference and guide. It is not intended to be used as tax advice or as a definitive source. Please feel free to get in touch with us or your CPA if you have any questions. As always, we are happy to work with you and/or your tax professional directly to address and advise on any specific questions pertaining to your personal circumstances.

Comments